In the previous posts we went through:

- how governance frameworks can add traction to a fast changing business environment connecting strategy with execution

- how incumbents in the financial sector can evolve by establishing interfaces with fintech innovators

In our review of the fintech environment we focused on banking, however disruption in insurance spans from business model innovation to smart contracts.

The following value propositions caught my attention as I was reviewing the instech landscape:

- Evosure (now IVANS part of Applied) allows brokers to describe the type of risk they have and finds a matching underwriter. (http://evosure.com/)

- SocialIntel offers underwriting based on social media profile constantly reevaluating risks, not just at initial underwriting and renewal times. (http://www.socialintel.com/)

- BizInsure focuses on efficient small business insurance. http://www.bizinsure.com/

- Zenefits provides HR software, making money on health insurance sold through that software. https://www.zenefits.com/

P2P insurance taps in the origins of mutual insurance and provides alternatives throughout the insurance value chain:

- Lemonade in US claims to be the “world’s first P2P insurance carrier”. http://lemonade.com/

- Friendsurance in Germany operates as a broker pooling risk from groups of friends. http://www.friendsurance.com/

- Inspeer in France pools deductibles between groups of friends enabling high deductibles thereby reducing the premium paid to the carrier. https://www.inspeer.me/

- Guevara in UK (I’ll pretend not to care that they’re saying goodbye to meerkats) present an interesting alternative for motor insurance emphasizing on affinity and transparency. https://heyguevara.com/

(The Guevara model is as interesting as the Guevara team, so I urge you to read more about it in http://dailyfintech.com/2015/12/24/guevara-moral-hazard-and-the-future-of-p2p-insurance/)

These innovative approaches may redefine the value proposition in parts of the value chain and should definitely be studied by insurance incumbents however we should not forget that these offerings are not burdened by legacy silo business practices. Despite the instinctive reaction that legacy IT would be the barrier to innovation, it turns out that the challenges posed by legacy infrastructure can be overcome.

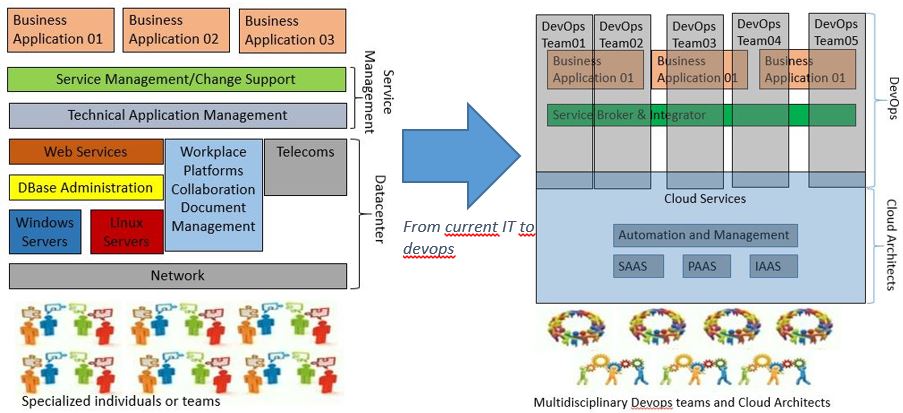

There definitely are challenges posed by infrastructure to incumbents: Moving to a devops culture is essential in order to implement a cloud centric strategy. Again the technical part is the least painful part of moving from the current IT organization to devops:

|

However moving to a cloud centric strategy is not optional. Cloud skepticism today is equivalent to internet skepticism around 15 years ago. Well, we all know how things worked out regarding that controversy. If you need a more convincing reason on “why cloud now” consider Big Data.

In order to start working on Big Data you need to work on a cloud enabled infrastructure environment, and if you are wondering what does this have to do with the insurance disruptors mentioned before, think how SocialIntel drives their innovative risk assessment engine.

Team transformation is not the only IT related challenge but is the most prominent one. Moving from monolithic applications to a microservices based architecture in a way that security scales by design, is another challenge, but the mitigation tactics for this challenge are well defined by now.

IT infrastructure challenges for incumbents are considerable indeed. However they are well defined and so are the mitigation tactics. Innovation strategy and execution is much harder exactly because it spans way beyond the legacy IT infrastructure challenges to organization and mentality silo restrictions.

An exception among incumbents is AXA with a clear innovation strategy. AXA Strategic Ventures rocks and its investment in blockchain provides an insight on how claims management –one example out of many- will be swept off its feet when smart contracts come into play. Blockchain 2.0 and programmable contracts are extremely interesting topics that move on a stream parallel to that of the cryptocurrencies.

Imagine an event like a health incident, or a flight delay being transmitted over a blockchain 2.0 platform so that the related smart contracts are automatically enforced and policy holders are automatically reimbursed. It kind of changes the way claims are managed today!

This approach to innovation proves that there are ways to overcome the short sighted quarter results focused mentality that dominates insurance incumbent strategies.

The speed at which things are changing won’t get any less. Technology won’t wait for the insurance industry to catch up. Even if smart contracts look like a blurry vision far ahead (despite the fact that anyone can experiment with platforms like Ethereum today), the immediate next steps are crystal clear for incumbents in the insurance industry.

Setting up a two speed IT strategy is a key step. Keep the shop running and experiment with new technologies in a structured way. Design a flexible cloud centric architecture that will allow for a modular replacement of legacy systems and provide interfaces for cooperation with disruptors. Invest heavily on automating workflows. Smooth optimization of processes through automation is the best way to prepare for a services based business architecture that will be able to accommodate smart contracts in the –not so far- future.

Evolving from 3-5 year plans and IT projects to an ongoing companywide transformation process will be painful for most organizations but this is not just another step in technology innovation that we are making. It’s a whole new industrial revolution that spans across industries.