It’s hard to find an organization today that isn’t in a phase of what is called digital transformation and already there is evidence of between 66%-84%[1] of these efforts failing.

How’s this digital transformation trend different to the e-everything trend of the late 90s. Why isn’t this just another overestimated tech promise? Wouldn’t it be preferable for an organization to wait until tech matures and then select through which projects will comprise the digital transformation program?

This is a common question, shaped by previous experience. For more than six decades technology was evolving in almost predictable cycles lasting between 10 and 20 years. Based on that, the question “should we wait until technology matures” sounds reasonable. Well, despite sounding reasonable this question is no longer valid.

Long maturing phases for new technologies as well as the almost exclusive tech usage for operational performance improvement made them only relevant to operations and almost detached from strategy and business models. That is how the question “should we wait and see” surfaced once more around the year 2000.

Since then, we’ve experienced two more tech phases maturing, providing evidence that the timeframe from experimentation to maturity shrinks as more and more new technologies are built on previous ones. What were once 10-20 year cycles have turned into 2-5 years cycles and we’re moving towards a continuously evolving tech fabric. More importantly, it’s not just technology that evolves improving operational performance. Business models, corporate strategies and industry structures are all also challenged by new value propositions based on evolving technology.

This is the simple reason why the question “should we wait until technology matures” may have been valid in the past but isn’t anymore. From 2005 onwards many technologies that have been developing as derivatives of mature ones converged to what was covered by the umbrella term 3rd platform[2], introduced by IDC. This brought together social media, mobile, cloud and big data in one conceptual framework.

Technologies in this framework will continue to evolve and be enriched with others that are either completing a long maturing cycle (AI), surface as modern technologies that have augmented existing ones (software robotics) or a ground-breaking combination of existing ones (blockchain).

Firms need to adapt into this new environment where:

- Intangible assets are more important for the valuation of an organization[3].

- Products, services and distribution channels are co-developed with other entities from the common value network (customers, suppliers, and partners).

- Infrastructure is offered as a service.

- Application development tools evolve at an unprecedented pace.

- HR management is redefined by robotics process automation.

In this environment organizations are called to redefine their value propositions based on the opportunities presented by the tech fabric weaved by the rapid convergence of technologies around mobile and cloud. This should ultimately be the target of any digital transformation effort and the need for continuous development following the completion of the first phase makes the term digital evolution more appropriate.

So digital evolution is the mandate within a reality defined by challenges where:

- There is pressure for immediate financial benefits and operating cost reduction.

- It’s difficult to approve any project that is not regulatory or will not have an immediate positive impact on profitability.

- All initiatives are evaluated with backward looking accounting metrics (ROI, IRR) ignoring metrics like sentiment or network value that affect more than half of a firm’s market valuation.

- Digital transformation is considered an IT project.

- Robotics will challenge HR.

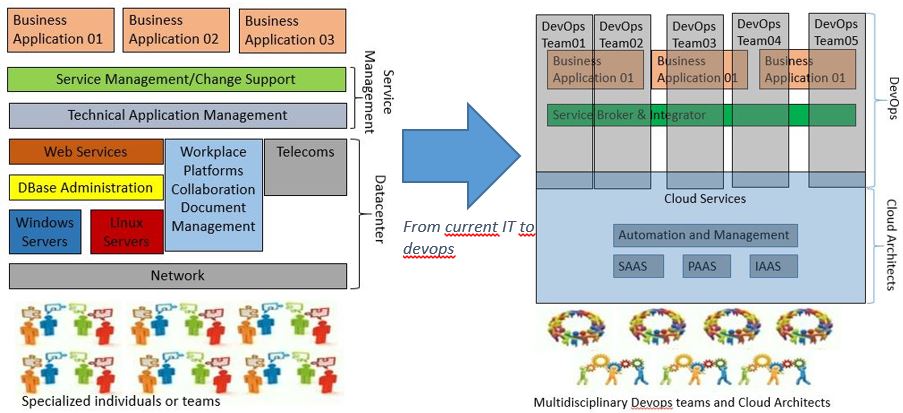

- IT infrastructure is based on legacy silo systems that in the best case scenario, will need 2-4 years to be replaced by a modular and flexible IT service broking architecture.

So we know today, that the accelerated convergence of technologies is challenging strategies and business models, as their impact goes beyond operational efficiency that has been within the IT realm for the last 50 years. That is why digital evolution is not a strategic option. It is the inevitable evolution of the business landscape and adapting to it or not isn’t really an option.

This is why every management team should have a clear view of what digital evolution means for their organization and be committed to it. Knowledge and commitment at the highest level is crucial as the cuts needed during this process will be deep and will never be completed if digital evolution is considered as a “digital project”. Digital evolution is not another project competing for resources. Considering it as this, exacerbates the risk of demoting the digital evolution initiative to a digital IT upgrade.

Unless the HR Director or the CIO are members of a leadership team committed to the digital evolution, how will they handle the disruption caused by robotics process automation[4] or the strengthening of the value network[5] of customers and partners?

No matter how strong the vision is, the aforementioned constraints are deeply rooted and the only way forward is through a realistic strategic roadmap that will within a reasonable time frame (for example 2 years with a major milestone every 6 months) complete the first step towards the digital evolution.

Let’s see how that would work for an incumbent financial organization: A digital working group manned by management team members would undertake the task of educating the rest of the team and cross reference the firm’s functional architecture and business model with the fintech landscape. They would aim at selecting a couple of proof of concept/value projects that would work as the bootstrap phase of the digital evolution. Such PoC/V projects could be RPA or the cooperation with a fintech partner or even a blockchain related initiative, depending on the digital maturity of the organization.

This process sounds like an extremely tedious task as a result of the uncertainty dominating FY17. But one thing is certain: It will be harder to cover lost ground in FY18. So as the new financial year begins, form your working groups, select your partners and gear up for the first phase of the digital trip moving towards FY19.

Acknowledgment: Tim Richards thanks for editing

[1] https://hbr.org/2016/07/7-questions-to-ask-before-your-next-digital-transformation?utm_source=twitter&utm_medium=social&utm_campaign=harvardbiz

[2] http://www.idc.com/prodserv/3rd-platform/

[3] https://hbr.org/2014/11/what-airbnb-uber-and-alibaba-have-in-common

[4] https://betterworkingworld.ey.com/better-questions/robots-help-business-be-human

[5] https://www.eycom.ch/en/Publications/20151221-Understanding-the-sharing-economy/download